We endeavour to generate economic value in an environmentally responsible and socially inclusive manner. Our investment is carefully channelized to expand our capacities, groom our human asset, create employment opportunities, and bring advanced technologies in manufacturing and giving back to society and nature

We have continued to grow and evolve, creating value by building competitive global-scale businesses. Our performance is benchmarked among the best textile businesses and we have consistently outperformed.

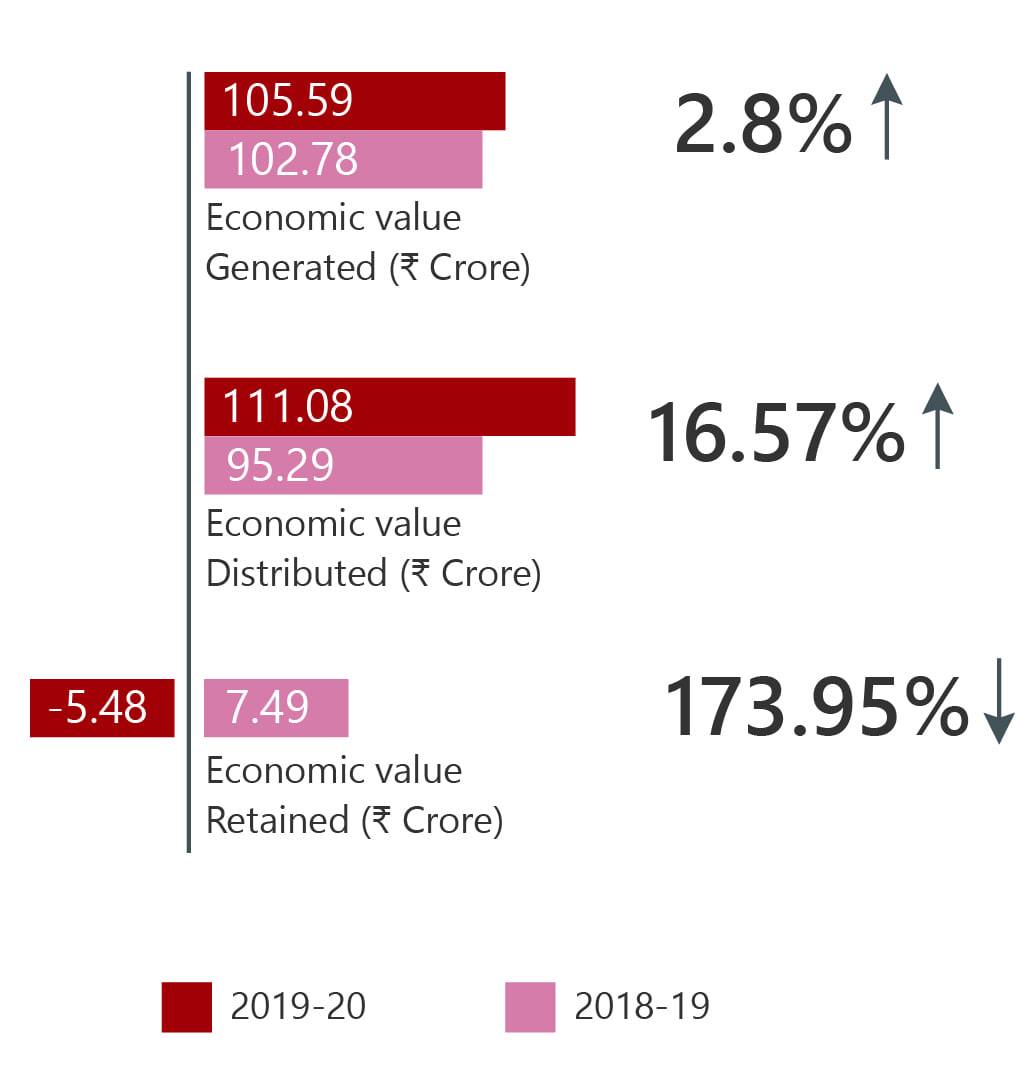

VIKRAM WOOLLENS

During the FY 2019-20, Vikram woollens economic value generated grew by 2.8%, while the distributed value also increased by 16.57%. However, retained value saw a significant decline of around 173%.

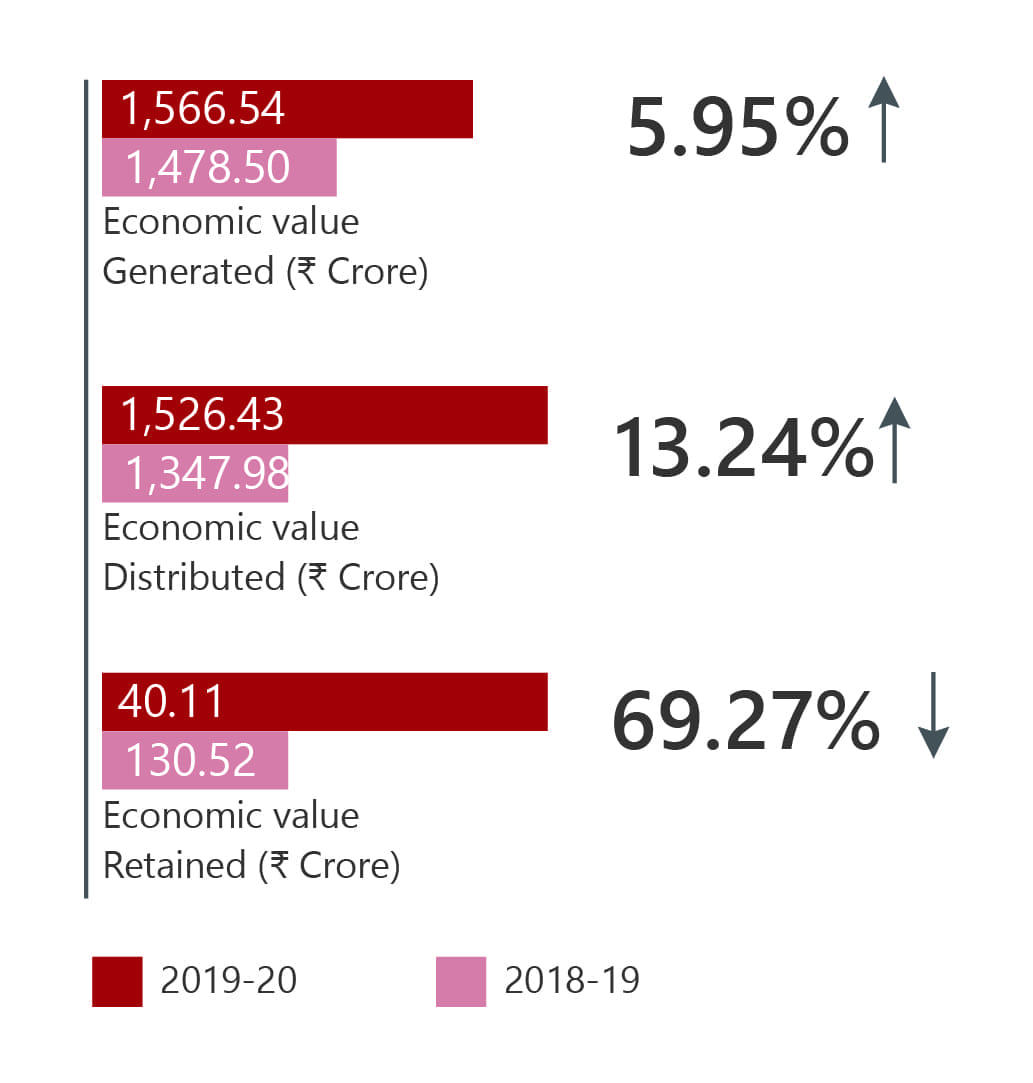

JAYA SHREE TEXTILES

During the FY 2019-20, JST economic value generated grew by 5.9%, while the distributed value also increased by a good margin in the operating costs. However, retained value saw a significant decline in comparison to the last year.

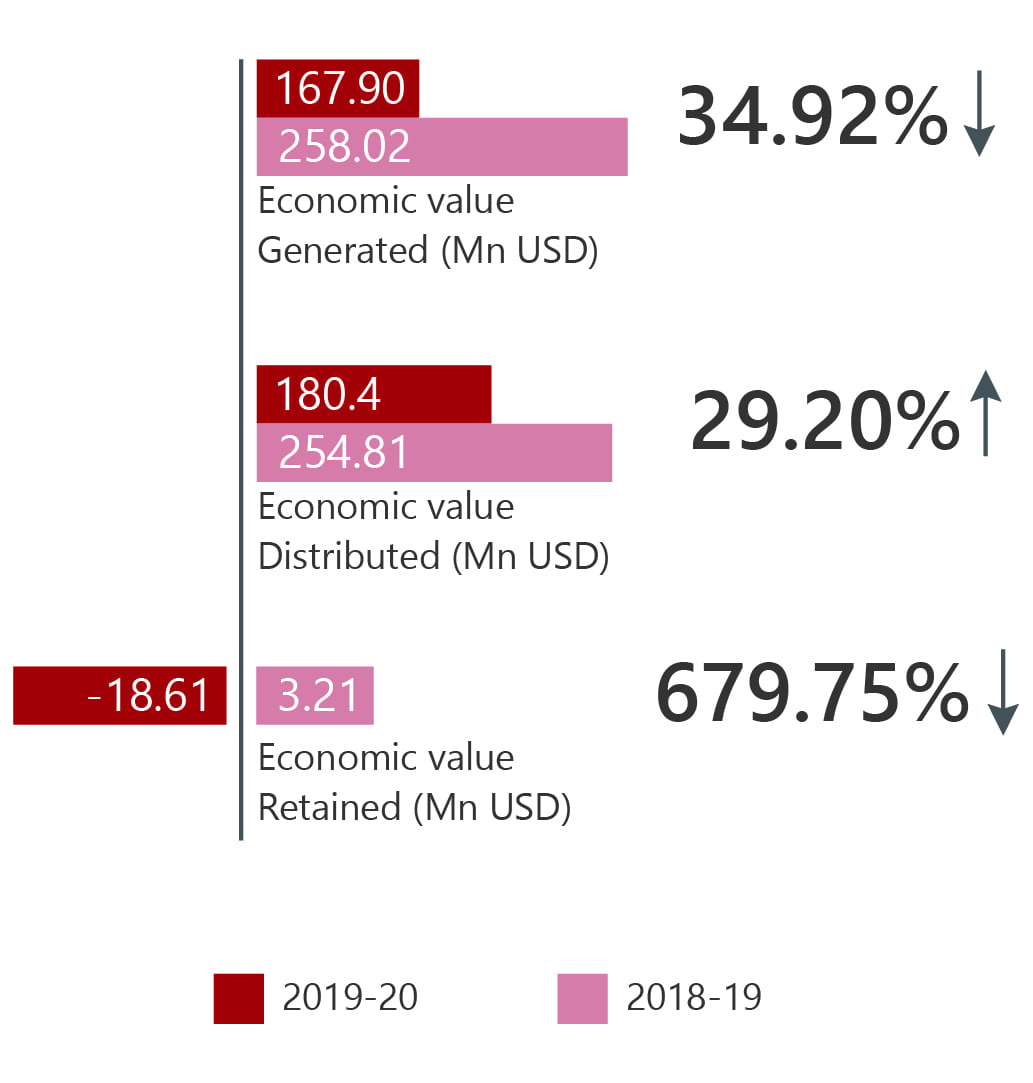

THAI ACRYLIC FIBRE

During the FY 2019-20, TAF economic value generated decreased by 34.92%

PT ELEGANT TEXTILE INDUSTRY

During the FY 2019-20, PTE economic value generated declined by 12.2%, while the distributed value increased by a small margin. The year also saw double in spending related to community development. However, retained value saw a significant decline in comparison to the last year

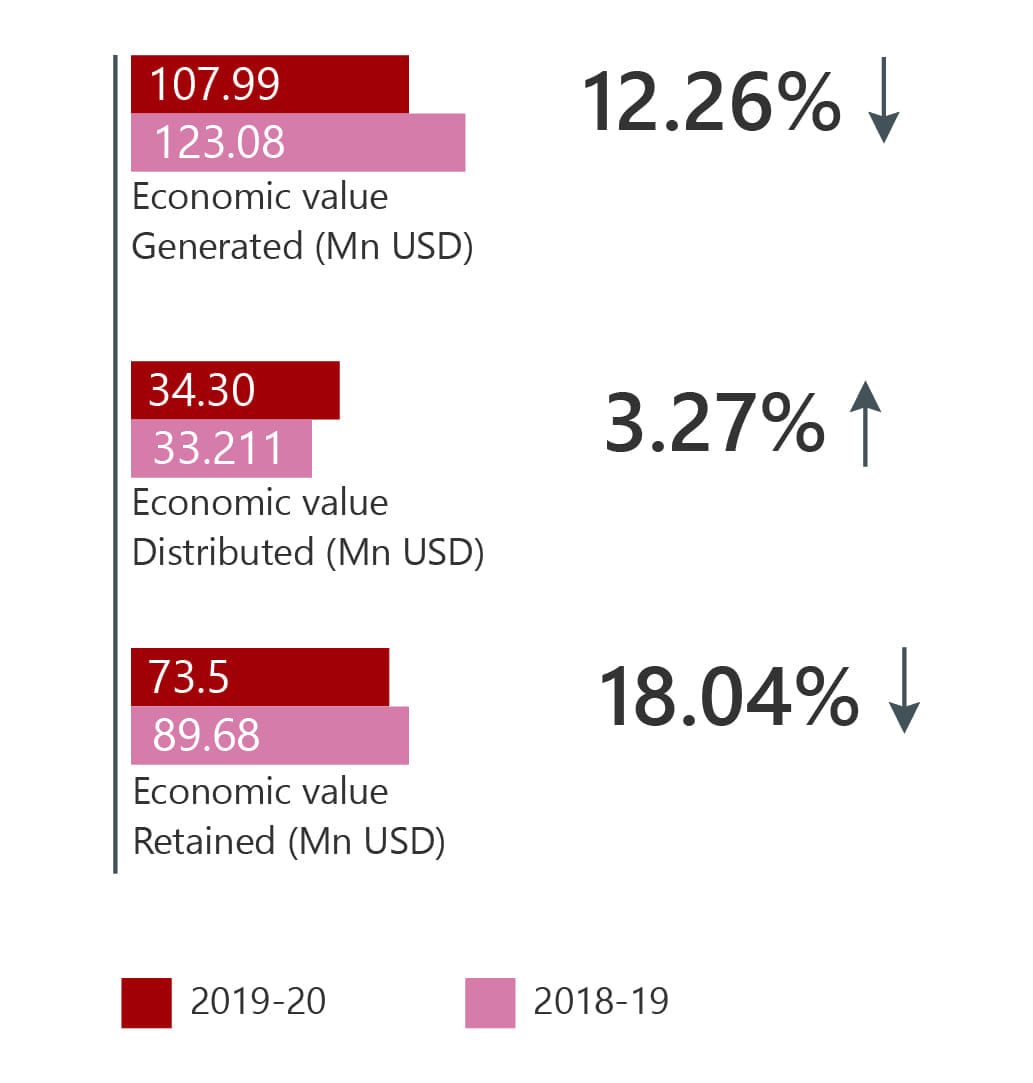

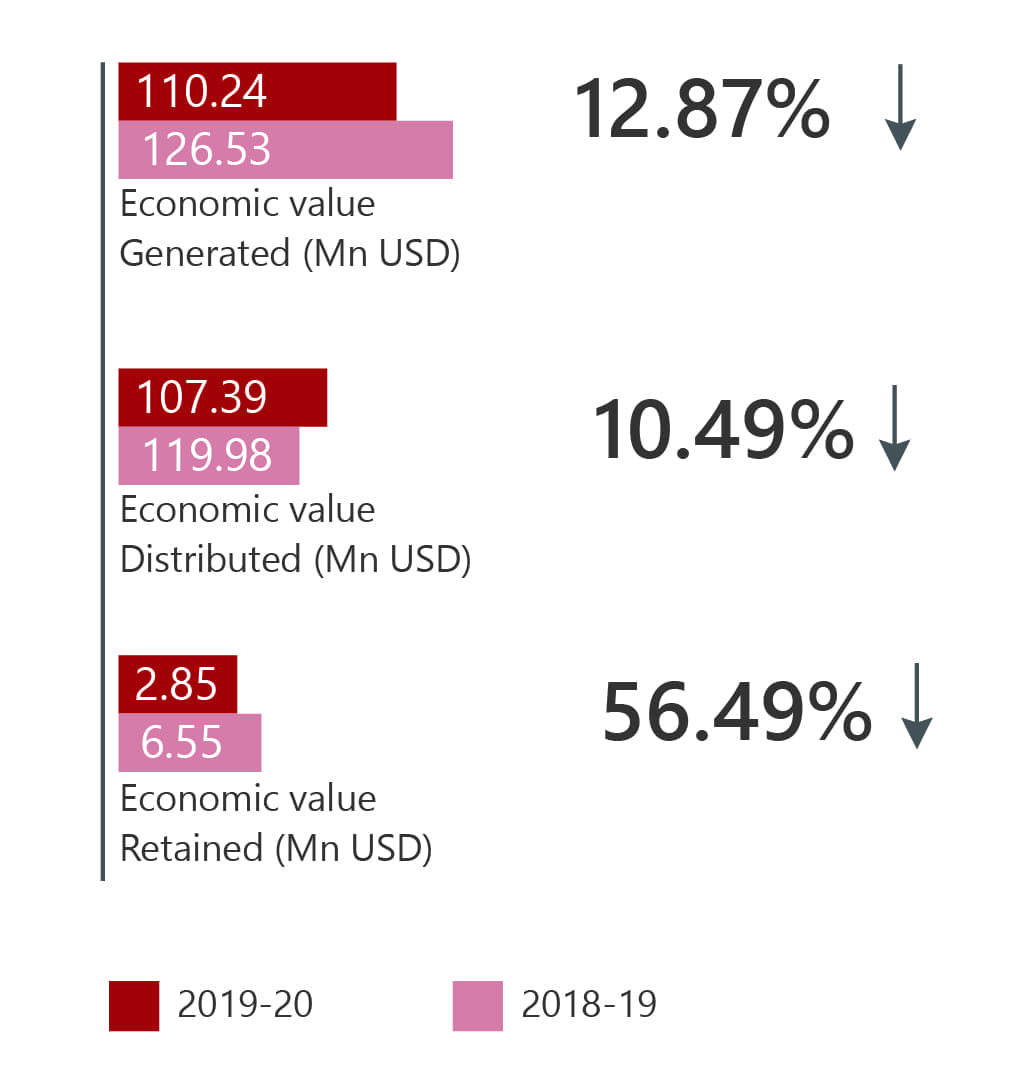

PT INDO LIBERTY TEXTILES

During the FY 2019-20, ILT economic value generated declined by about 12%, as well as distributed and retained value declined by 10% and 56% respectively.

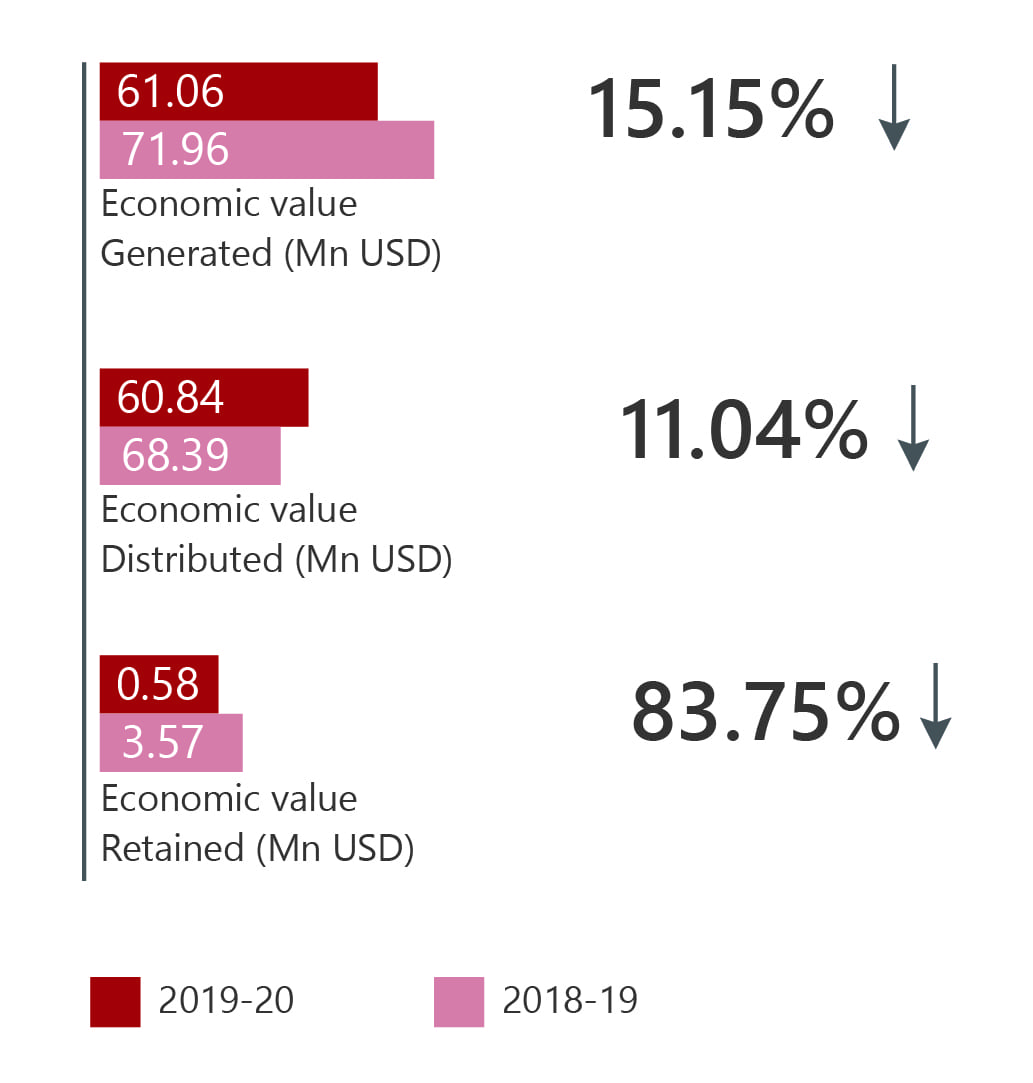

PT SUNRISE BUMI TEXTILES

During FY 2019-20, PTS economic value generated declined by 15.15%, while the distributed value decreased by a small margin for the employees. The year also saw a double in spending related to communities development. However, retained value saw a significant decline in comparison to the last year.

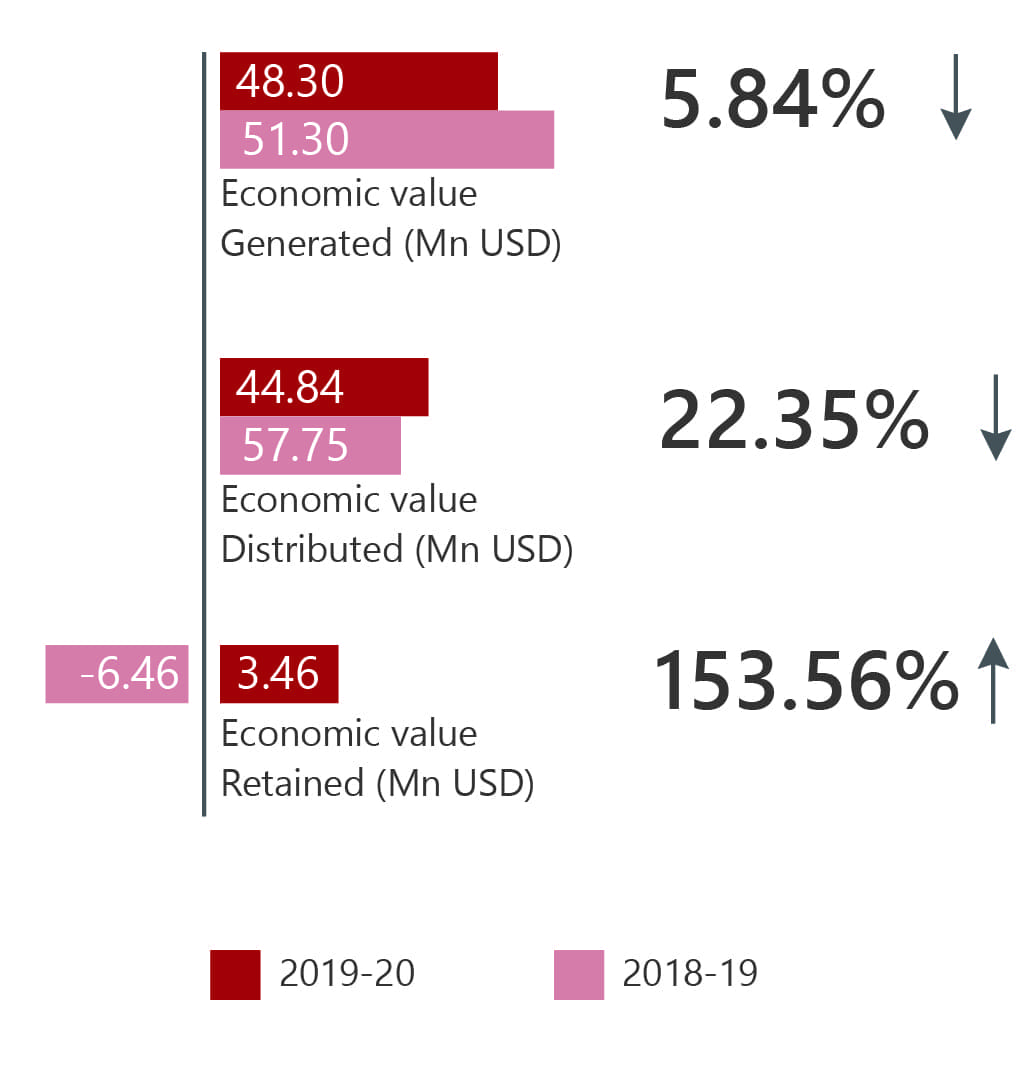

INDO THAI SYNTHETICS (ITS)

During FY 2019-20, ITS economic value generated declined by 5.84%, while the distributed value also decreased by 22%.

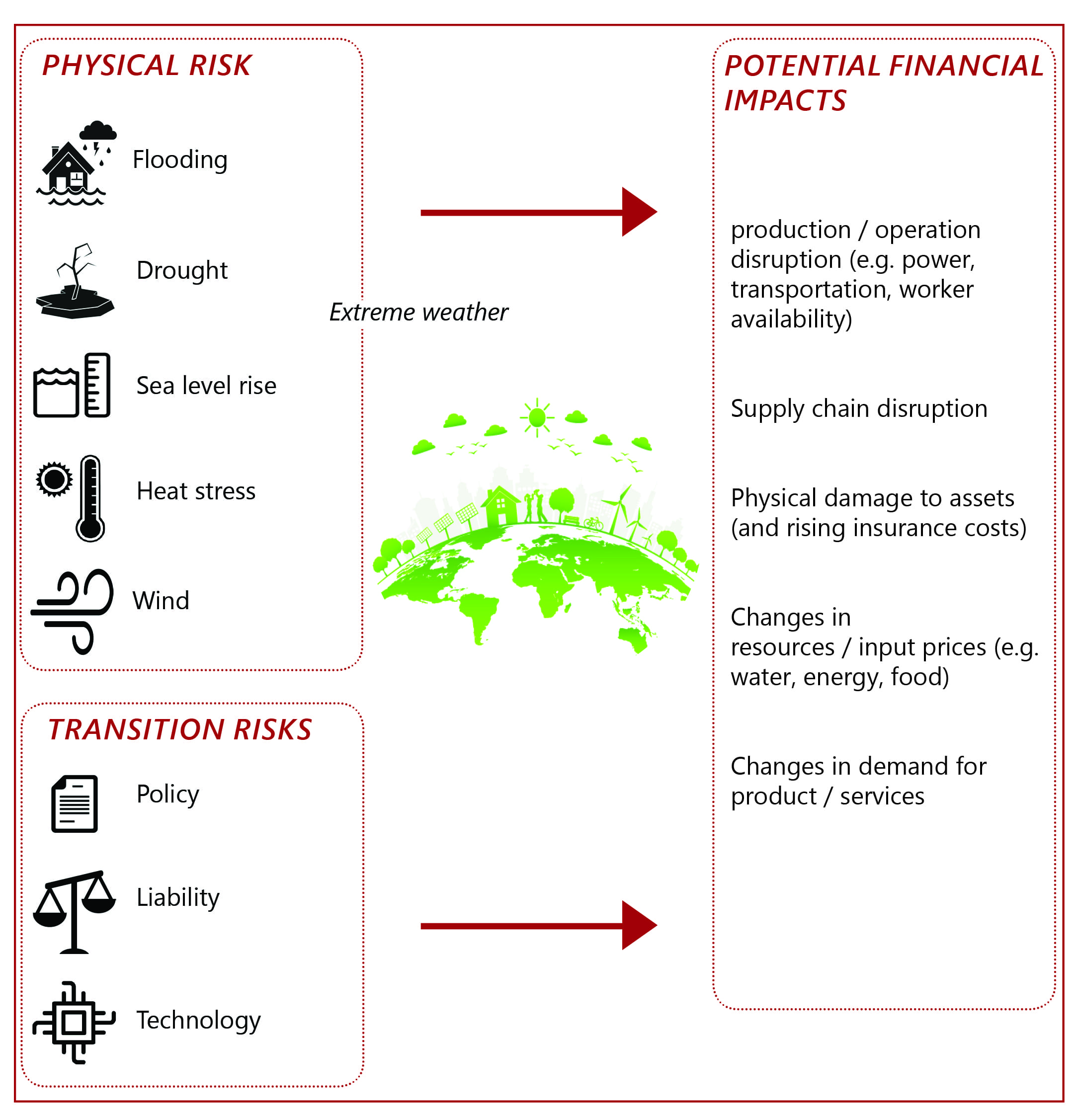

We recognize that climate change is the greatest challenge we face as a global community. Its impacts are widespread, and its risks are not limited by continent, industry, or even species. Climate change has the potential to impact our business operations, economic value generated and retained across the supply chain, and revenues.

Textile being the major sector which is closely monitored on many ESG related issues, the focus areas of stakeholders center around climate change, waste from operations, fresh-water shortages, energy use, human rights, and the reduction of toxic substances.

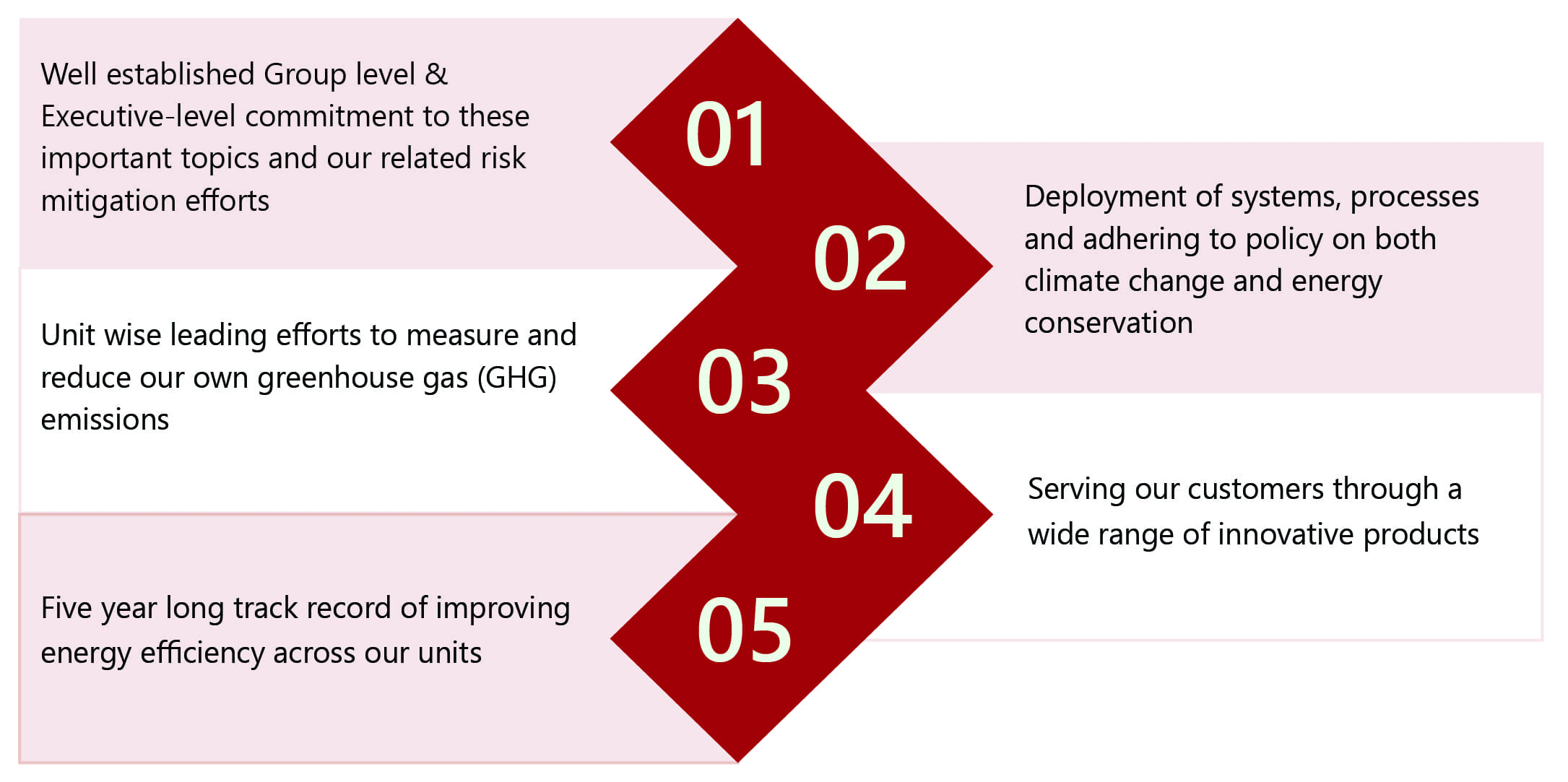

We proactively address challenges and seek opportunities presented by climate change by:

We assess the risk of climate change and undertake integrated action to long-term investment to mitigate those risks. It is an integrated approach and constitutes a part of the risk management framework. As we identify these risks we examine, discuss and take mitigating measures, and wherever required appropriate resources, particularly financial resources, are provided to mitigate and monitor it continuously. These major risks and opportunities due to climate change are: